What is SECR?

SECR has been introduced in the UK by changes to the Companies (Directors’ Report) and Limited Liability Partnerships (Energy and Carbon Report) Regulations SI 2018/1155. Its introduction coincides with the closure of the Carbon Reduction Commitment and came into force on 1st April 2019. It is part of the UK government’s ongoing commitment “to help businesses to improve energy efficiency and reduce carbon emissions.” SECR aims to build on other nationwide mandatory energy and carbon reporting schemes like ESOS and Green House Gas reporting (GHG).

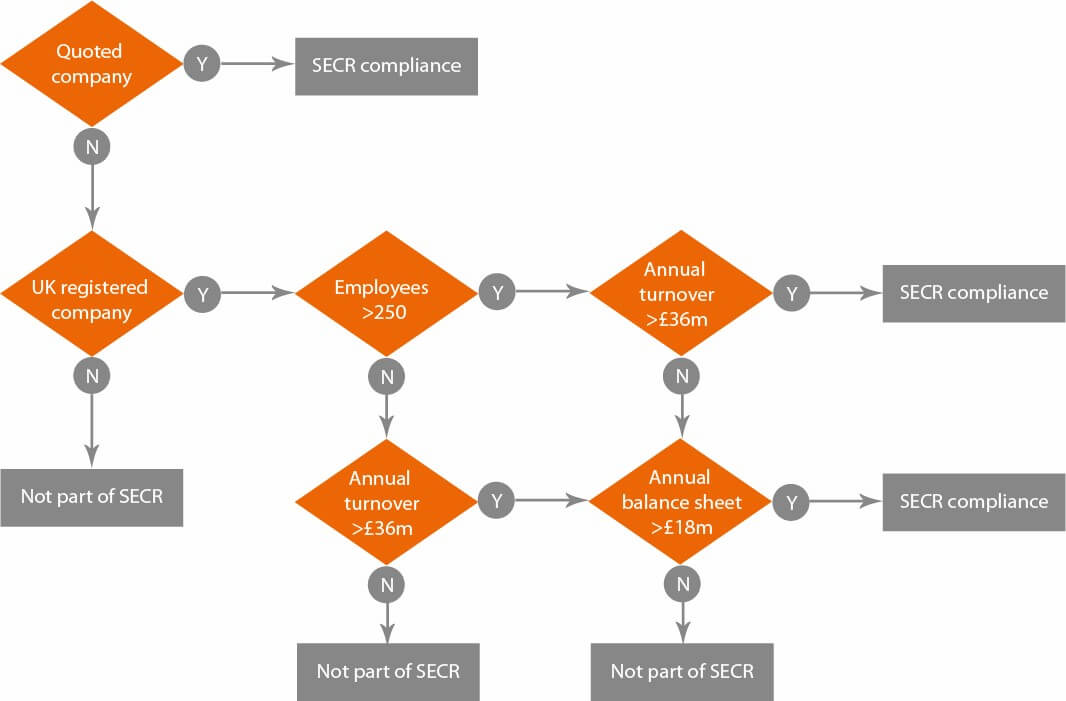

Approximately 11,900 organisations will need to comply with SECR – these include all quoted companies, large unquoted companies and limited liability partnerships (LLP). The definition of ‘large’ is the same as in Companies Act 2006. The company must satisfy two of the following conditions:

1. More than 250 employees

2. Have an annual turnover £36 million or more

3. Have a balance sheet £18 million or more.

Large companies which use less than 40 000 kWh in a year can opt out.

What do companies have to report?

Quoted companies must report their global energy use (in kWh) and their scope 1 & 2 emissions (in CO2) from activities for which the company is responsible i.e. the operation of its facilities. This includes the annual emissions from the purchase of electricity, heat, steam or cooling for its own use. Scope 1 also includes any fugitive emissions e.g. from air conditioning units.

Large unquoted companies and LLPs must report, as a minimum, their UK energy use (electricity, gas and transport in kWh) and the associated greenhouse gas (GHG) emissions in tonnes of CO2 only. Transport energy includes the fuel directly used by the company in onsite vehicles, company owned/leased vans and cars including rental cars or employee-owned vehicles where the organisation are responsible for purchasing the fuel. It does not include fuel associated with air, rail or taxi journeys that the company does not operate, or fuel for the transportation of goods contracted to a third party.

All companies must include the energy use and GHG emission figures from the previous year. In addition, an emissions “intensity metric” will have to be provided such as the amount of CO2 released per tonne of production or product sold, or per £ turnover or per FTE staff. The intensity metric can be chosen by the company and multiple can be used.

The methodology used to gather the SECR data must be stated. This may already be partially captured in the records for ESOS (Energy Saving Opportunities Scheme) compliance and any management systems (ISO14001 and ISO 50001) monitoring. There are also internationally recognised Guidance/Standards, such as the Greenhouse Gas Protocol, which can be used as a methodology for ensuring compliance with SECR requirements. Any energy efficiency measures taken during the year should also be included in the report.

Organisations can choose whether or not to report their Scope 3 emissions, this includes the emissions from their supply chain or downstream from their sites e.g. waste disposal.

Companies in scope of the legislation will need to include their energy and carbon information in the first annual directors’ report (accounts) submitted to Companies House that covers the financial reporting year starting on or after 1st April 2019. For example, if the reporting year is 1st January – 31 December, the first financial year for which the relevant report must comply with the new requirements is 1st January 2020 – 31 December 2020 i.e. the report filed covering this year.

For more information on SECR and for help understanding whether you need to comply, please contact us.

Image from:https://blog.anthesisgroup.com